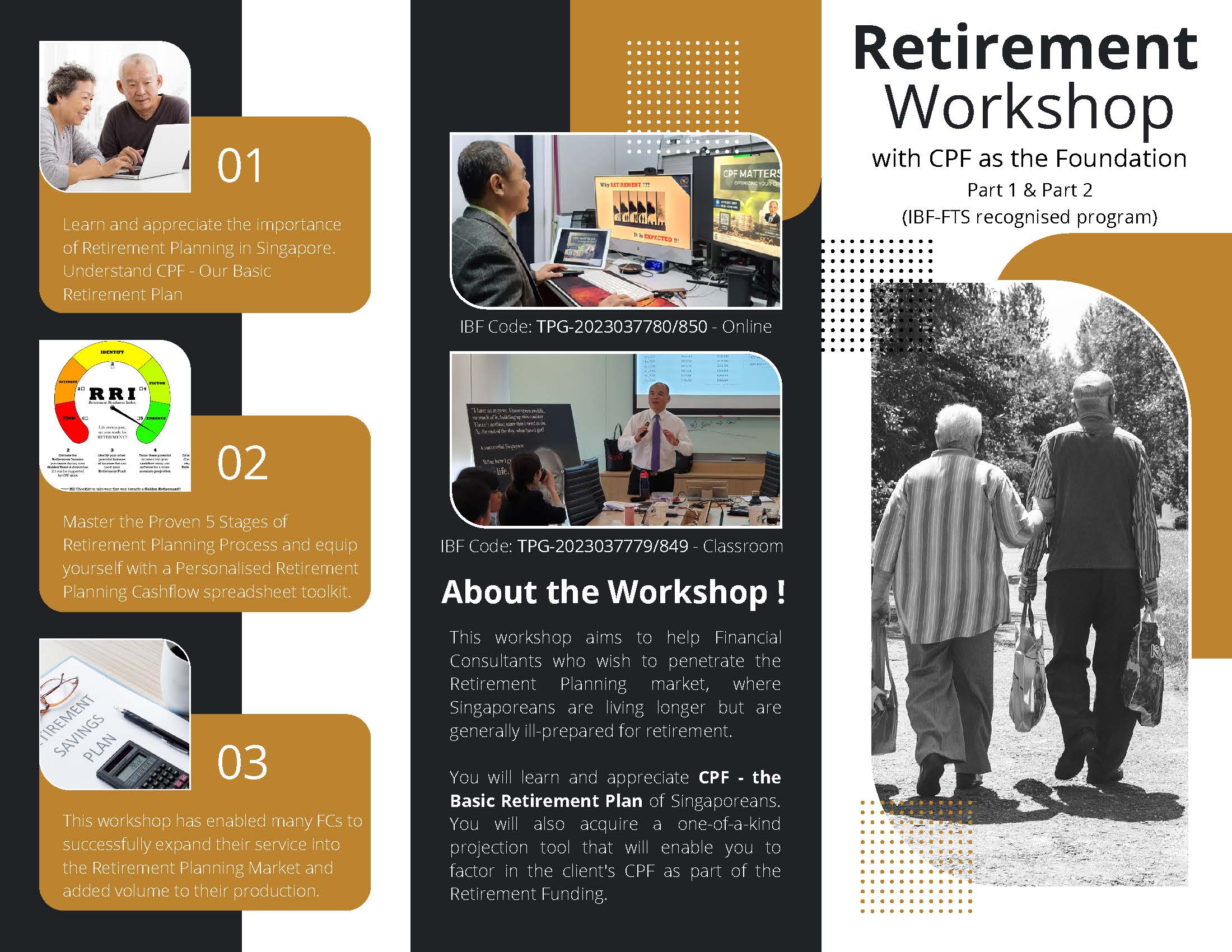

Retirement Workshop with CPF as the Foundation

Classroom Course Part 1 IBF Course Code: TGS-2023037779 / Course fee: $500

Classroom Course Part 2 IBF Course Code: TGS-2023037849 / Course fee: $500

Online Course Part 1 IBF Course Code: TGS-2023037780 / Course fee: $400

Online Course Part 2 IBF Course Code: TGS-2023037850 / Course fee: $400

IBF-FTS Subsidy

Singaporeans aged 40 years old and above: 70% co-funding (Net fee payable: $150/$120 for Classroom/Online respectively)

All other Singaporeans and PRs: 30% co-funding (Net fee payable: $350/$280 for Classroom/Online respectively)

(Both are capped at S$500 per participant per course.)

Details of IBF-FTS: https://www.ibf.org.sg/home/for-individuals/skills-and-jobs-development/training-support/IBF-FTS

A proven Workshop that has helped many Financial Consultants to break successfully into the Retirement Planning Market

We're Here To Help You Succeed in your Retirement Planning Service

About The Workshop

This workshop is specially designed for Financial Consultants aiming to penetrate Singapore's retirement market. You will get to understand and appreciate CPF - the Basic Retirement Plan of Singaporeans. You will also access a one-of-a-kind projection tool that will enable you to factor the client's CPF into the Retirement Funding.

Course Delivery

You can choose to attend Part 1 and Part 2 either Online or Classroom combination. The training hours for each Part of the Workshop is 7 hours, inclusive of 30 mins Online Assessment.

COMPLIMENTARY

All graduates of the Workshop are welcome to attend the periodic Meet Albert Session, where their Retirement Planning Skills will be sharpened further.

The IBF subsidy mentioned by Mr Albert Seah in the video above refers to past rates. Details of current IBF-FTS can be found at https://www.ibf.org.sg/home/for-individuals/skills-and-jobs-development/training-support/IBF-FTS

COURSE OUTLINE

Part 1: Session 1 & 2 / Part 2: Session 3 & 4

________________________________________________

Session One

Topic: Understanding Retirement Planning in Singapore

- Overview of retirement planning and its importance.

- Challenges faced while retiring in Singapore.

- Timing for starting retirement planning.

- Potential of the retirement planning market.

Topic: Understanding CPF - Your Basic Retirement Plan

- General understanding of CPF as the basic retirement plan for most Singaporeans.

Special Highlights:

- CPF’s role during retirement years.

CPF as a wealth accumulator.

Contribution, allocation, and limits.

Retirement sums and CPF at 55.

Additional interest on the first $60k combined CPF balances.

Session Two

Topic: Special Highlights (Continue)

- CPF retirement-related schemes: Basic Healthcare Sum, Retirement Sum Topping Up Scheme, Property Pledging, Voluntary Contribution, and Voluntary Housing Refund.

- CPF Top-Up and Medisave Contribution for tax planning.

- CPF Life Schemes.

- Understanding CPF changes in 2025 and their implications.

Session Three

Topic: Mastering the Retirement Cashflow Spreadsheet

- Learn the Five Stages of Retirement Planning Process.

- Generation of 14-Page Report.

- Practical Hands-on session of Stages 3 to 4 planning.

- Perform Stage 4 Assessment.

Session Four

Topic: Mastering the Retirement Cashflow Spreadsheet (Cont...)

- Practical Hands-on session of Stages 5 planning.

- Planning for Aged 55 and above.

- Planning for Self-Employed.

- Further Applications of the Retirement Cashflow Spreadsheet.

Ready to find out more? Get started today!

Acquiring additional skills is never too much. You never know when you need it.

Our Reviews and Testimonials

________________________________________________

Since 2016, more than 4,000 Financial Consultants have attended our Retirement Workshop with CPF as the Basic Foundation course.

This Workshop has equipped many FCs with a unique set of Retirement Planning Skills and Planning Tools that enabled them to successfully expand their service into the Retirement Planning Market and added volume to their production.